Voters have new leeway on sales tax in Granite Shoals

Sales tax is not new in Granite Shoals, but application of the funds has new leeway. it will take voter approval to keep all of it coming in and directing according to the research the city council conducted.

Early voting began Monday, April 25 and continues today, April 29, from 8 a.m.-5 p.m., Monday, May 1, from 7 a.m.-7 p.m. and Tuesday, May 2, from 8 a.m.-5 p.m. at the Burnet County Courthouse at 220 South Pierce Street (on the square) and the Marble Falls Courthouse Annex, 810 Steve Hawkins Parkway.

On election day, Granite Shoals voters, both from Voting Precinct 3 and Precinct 18, cast ballots in the Marble Falls Independent School District and City of Granite Shoals elections at the Granite Shoals Fire Station, 8410 Ranch to Market Road 1431.

Propositions on the ballot are:

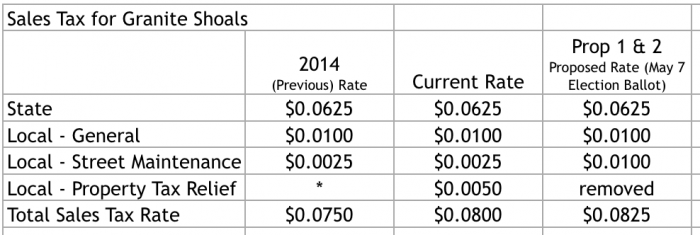

PROPOSITION 1: The adoption of a local sales and use tax in the City of Granite Shoals at the rate of one percent, the adoption of a local sales and use tax in the City of Granite Shoals at the rate of three fourths of one percent to provide revenue for maintenance and repair of municipal streets, and the abolition of the additional sales and use tax within the city.

PROPOSITION 2: The reauthorization of the local sales and use tax in the City of Granite Shoals at the rate of one fourth of one percent to continue providing revenue for maintenance and repair of municipal streets. The tax expires on the fourth anniversary of the date of this election unless the imposition of the tax is reauthorized.

Many voters have asked why two propositions exist and what they need to know to make a decision. The options were approved for the ballot, in part, because some sales taxes must be re-affirmed by voters and, also, because the Texas legislature has given cities more leeway in the use of the sales taxes they approve.

The only way the City of Granite Shoals will be able to garner two cents of every sales tax dollar for city use (a penny for the general fund and a penny for street maintenance) is for voters to approve both propositions on the ballot.

PROPOSITION 2 on the ballot is most easily explained: It is the legislatively-required re-authorization of a quarter of a cent on the dollar sales tax for street repair. A "no" vote removes the authority voters previously granted to collect the tax .

PROPOSITION 1 reads: “adoption of a local sales and use tax ...at the rate of one percent (a penny on the dollar), the adoption of a local sales and use tax ... at the rate of three-fourths of one percent (three-quarters of a cent on the dollar) to provide revenue for maintenance and repair of municipal streets, and the abolition of the additional sales and use tax within the city.”

Voters previously approved a half cent tax for property tax relief. A “Yes” vote for the PROPOSITION 1 releases that, re-directs the half cent and adds another quarter penny to streets. Combine that with, “yes,” on PROPOSITION 2, and a full penny is directed to streets and a full penny to the general fund.

If neither proposition is approved: the half cent now used to reduce ad valorem taxes will continue. The one cent now directed to the general fund will continue. The quarter cent for streets will go away.

Sales tax is not new in Granite Shoals. Unlike an unincorporated area like Kingsland where no taxing entity has the authority to level a local tax, voters in the incorporated city of Granite Shoals have previously approved sales taxation. Under previous rules of the Texas Legislature, some taxes must be re-approved and changes in their application also require voter approval.

Read about the candidates on the May 7 ballot in the Friday, April 29, edition of The Highlander and here on HighlanderNews.com