Marble Falls ISD adopts same tax rate for fifth year running

By Lew K. Cohn

Managing Editor

The Highlander

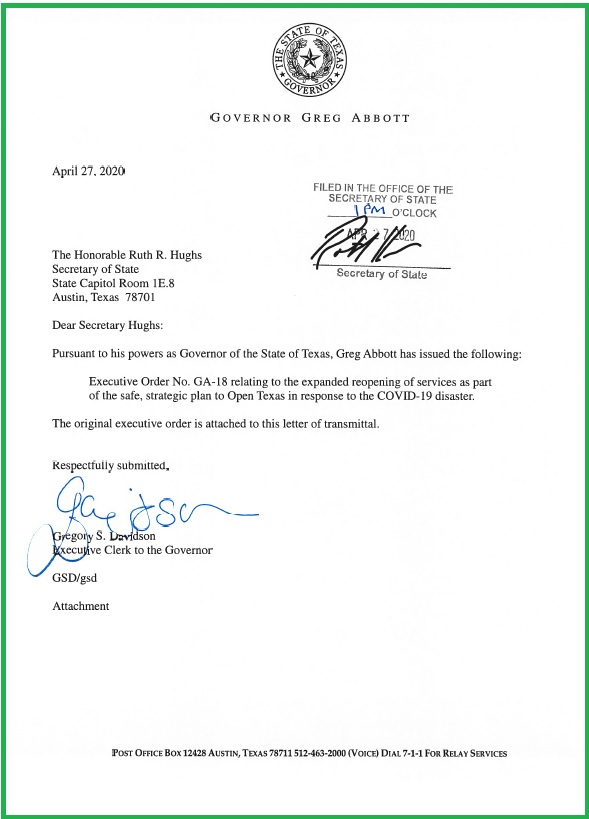

Depending on the value of their property, Marble Falls Independent School District taxpayers may see their individual taxes increase for the 2016-2017 school year, but they will be paying the same tax rate they have for the past several years.

MFISD trustees voted 5-0 on Monday, Aug. 29, to set a maintenance and operations tax rate of $1.0533 per $100 valuation and an interest and sinking tax rate of 22.67 cents per $100 valuation for a total tax rate of $1.28. It is the fifth year in a row the district has set its tax rate at $1.28 per $100 valuation.

School board members also approved an additional $1,123,595 in revenue and expenditures for the fiscal 2017 budget after learning that property values for the district had come in higher than expected.

District Finance Director Lisa LeMon said the district set a budget based on property value growth of about 0.5 percent and anticipated the district could see an increase in value of as much as 2.5 percent. However, the district's taxable values jumped by nearly $80 million, or about 3.4 percent, which will generate an extra $1,123,595 in revenue and allow the district to fund some additional personnel positions and make some capital expenditures as needed.

The district will also be responsible for paying about $89,000 more to the state as a property-wealthy school district in conjunction with the state school finance plan.

For more information about the tax rate and amended budget adopted by the board, please see Friday's Highlander.