Tanner steps down from Granite Shoals Council

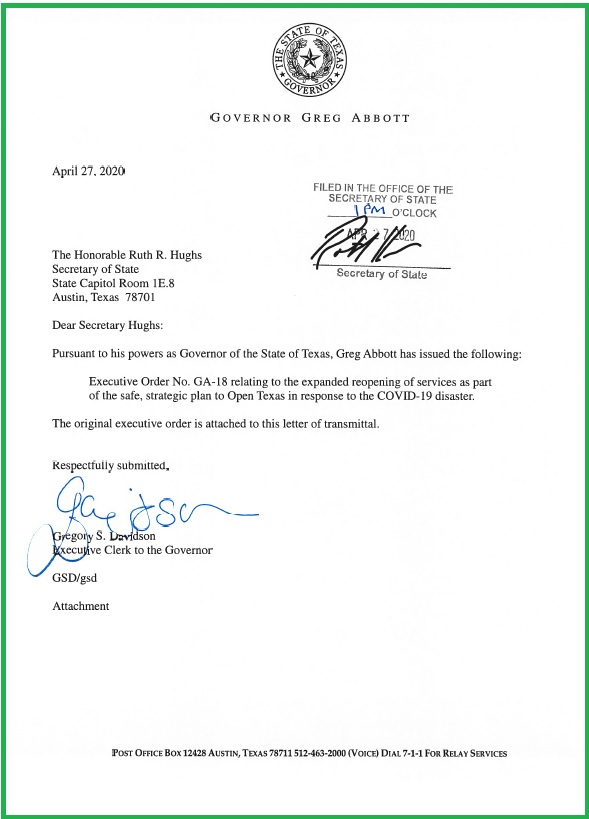

GLYNIS CRAWFORD SMITH/THE HIGHLANDER

Eric Tanner is stepping down from the Granite Shoals City Council to devote his energies to the Nov. 8 election in which citizens will choose whether to back desires for better words with a bond issue.

By Glynis Crawford Smith

The Highlander

Eric Tanner, first elected to the Granite Shoals City Council in 2011, has resigned with one thing on his mind: the Nov. 8 general election that could fund restoration of the city's major thoroughfares.

With the council set to approve the budget and tax rate tonight, Friday, Sept. 16, the Tuesday session put into motion the process for Tanner's replacement.

The city is seeking a grant for a $6.8 million project to re-work Valley View Lane, Prairie Creek Road and Phillips Ranch Road, not just in part, but from Ranch to Market Road 1431 to end of their lines at Lake LBJ or the city limits. Voters will decide Nov. 8 if they are willing to commit to $3 million in bonds to secure a grant through the U.S. Department of Agriculture for the project. That is what Tanner says he will promote.

“I will be enthusiastically campaigning for the passage of the street improvement bond issue that I helped bring before the voters,” said Tanner. “I feel that as a private citizen, where I can both educate my fellow citizens and actively advocate for the passage of the bonds, I can have a potentially more positive effect...than in the few remaining months of my last term.”

Tanner is a West Texas native with bachelor and master of arts degrees from Texas Tech University. He and his wife Helen moved to Granite Shoals in 1985. He served 10 years on the Marble Falls Independent School District Board of Trustees, the Planning & Zoning Commission (P&Z) and the very Granite Shoals Charter Committee that drew up the term limits, to which he must now adhere. A business information consultant to state and municipal government entities and a specialist in document management, he has applied his skills to volunteer assistance with citizen surveys, city document management and ordinance writing and codification.

Filling those shoes even until spring elections is a job the city council is taking seriously.

They are taking applications from anyone interest who returns an application form before 3 p.m. on Sept. 30. That will allow City Secretary Elaine Simpson to validate their residency and other qualifications before Oct. 3 for council review to keep the process moving toward the city charter mandate to replace a council member within 30 days of the vacancy.

The applications will be available through public information requests and the applicants will be interviewed in open session of the council on Oct. 11. Five votes from council are necessary to confirm a selection.

Tanner made the effective date of his resignation Sept. 17, but legally he must be considered part of the council until a replacement is sworn in Oct. 11. Former mayor Dennis Maier, concerned that would hamper Tanner's stated goal of working toward passage of the bond option was pleased with the answer from City Attorney Brad Young: “As a private citizen, any council member can support something; just not with city money or at a city council meeting or function.”

The council spent much of its time Tuesday night in a workshop concerning the problems that drainage of Elm Creek and Prairie Creek pose for the road project. In a city that has grown up from a subdivision without paving, let alone curb and gutter, drainage problems have come before the council and P&Z since well before 2007 flooding. Drainage of the two creeks to Lake LBJ have been part of street rehabilitation plans since the study presented a year ago at the forum on the project and, even from the initial study, it was clear that the cost of successful solutions on the two westernmost north-south thoroughfare would be considerable.

“A few months ago, I asked if I could confer with our firm's real estate attorney,” said Young. “She looked at both public records and records related to the city and it look as if Elm Creek is in Forest Hills and Green Valley Subdivisions in part of the (original) Sherwood Shores II Subdivision...It may be the case that you have some easements there, but it could be that you would need to acquire some easements.”

“Most property owners who realize it will help their property, will give those easements,” said Young. “But you have to identify them and contact them. There are special notices you need to post.”

Mayor Pro Tem Shirley King volunteered to assemble more records that would be needed and each council member had ideas about contacting what could turn out to be 200 residents along the drainage paths to the lake. Tom Dillard pointed to the success the city had in gaining cooperation of property owners of condemned structures.

“We know there is brush, large appliances, even old cars in the drainage path,” said Council Member Tom Dillard. “If we could identify those places, we could ask how we can help (as we did with unsafe structures). It is definitely in the public interest if a debris dam has formed.”

“Maybe we could cancel one of the two citywide clean-ups next year and devote that money to an Elm Creek clean-up,” said Council Member Anita Hisey.

The council seemed to concur with City Manager Ken Nickel, who said money for the work was not in the new budget.

“My view is we go forward after the November election,” said Nickel.

The council will meet again tonight, Friday, Sept. 16, to adopt the budget for the 2016-2017 fiscal year, to adopt the tax rate and to ratify the tax increase it reflects for the new budget.

The budget, with general fund expenditures of $6,784,677, requires a tax rate of $0.54720 per $100, a little over two and a half cents ($0. 0265) per $100 valuation more than the current rate of $.5570.

“Our county appraiser, Stan Hemphill, provides information that 61 percent of Granite Shoals taxpayers own property valued at $100,000 or less,” said City Manager Ken Nickel.

That would be $24.10 on a $100,000 property. The proposed tax rate is divided between $.2187 per $100,000 for the interest and sinking fund (I&S) and $.32850 per $100,000 for maintenance and operation (M&O), or general fund. That represents more for M&O than last year, an effective tax increase of 7.9 percent.