Courthouse steps go online in Burnet County: a Texas first

By Lew K. Cohn

Managing Editor

The Highlander

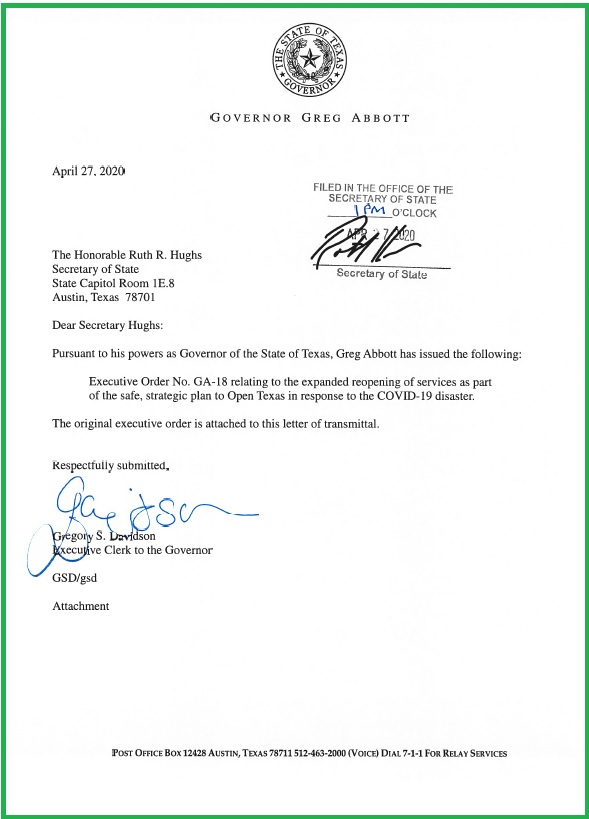

Burnet County will be the first county in Texas to take advantage of new legislation which allows property tax foreclosure auctions to be held online instead of on the front steps of the courthouse, a tax attorney assisting the county said Feb. 14.

The Burnet County Commissioners Court voted unanimously that morning to adopt a resolution permitting such sales to occur online and approving the setup of an online sales platform with assistance from the law firm of McCreary, Veselka, Bragg & Allen P.C. (MVBA), which performs delinquent property tax collections for Burnet County and other taxing entities.

Javier Gutierrez, an associate with MVBA, said Section 34.01 (a-1) of the Texas Tax Code, which was changed during the 2015 legislative session, now allows counties to hold online auctions of property foreclosed on due to failure to pay delinquent taxes rather than requiring the sheriff to hold a sale on the front steps of the Courthouse every first Tuesday of the month.

“We are still doing the business of collecting taxes the same way, but the only change now is that these types of auctions are allowed to be held online now and they don't have to be on the Courthouse steps,” Gutierrez said. “In the past, tax sales always had to be held the first Tuesday of the month and they were only taking place from about 10 a.m. to 4 p.m. and with a number of properties for sale, potential buyers didn't have a lot of time to bid.

“Now, with having an online auction, we can post the property online up to three to four weeks before that sale date for viewing and buyers can register before hand and can then set it up on the computer to put in a bid for the date of the sale.”

Online bidders will have to be registered to take part by creating an online profile and submitting their valid driver's license or state ID along with a credit card for vertification purposes. Each registered bidder will be individually vetted prior to the auction, which prevents bots from taking over the auction process.

Gutierrez said the online sales platform that will be used by the county is similar to how online auction giant eBay works, so bidders can set a maximum bid they are willing to pay on a property. If a new bid comes in from another online bidder, the system will put in a new bid for the original bidder in an increment $50 higher until that bidder has reached his maximum bid limit.

The system will only increase the bid if a new bid is submitted by another bidder. So, if a bidder sets a maximum limit of $5,000, but their current bid of $4,000 is the highest, it will not go above that amount until another bidder comes in with a bid of $4,050.

Successful bidders will be given 24 hours to complete the sale by paying either in cash or through a certified check at the Courthouse or using an online payment methods (either an ACH draft from a bank account or a credit card transaction). If an online payment method is used, a convenience fee of 2 to 3 percent of the sale amount may be charged.

The minimum bid that will be accepted for any property will be enough to cover all outstanding taxes, penalties and interest owed, “plus any other amount awarded by the judgment, court costs, and the costs of the sale,” according to the Section 34 of the Texas Tax Code.

Gutierrez said in a typical property tax foreclosure auction, there could be as many as 30 to 50 properties up for sale, which “can be daunting to someone who wants to bid.” The online platform, which is accessible through computer, smartphone or tablet, should change that.

“Under this system, they can pick what properties they want to follow and not have to stay there at the courthouse to be there for the auction,” Gutierrez said. “They have more time to bid since bids will be open for 10 a.m. to 2 p.m. on the day of the sale for all properties online. There is also more likelihood they may have the ability to get online.”

Gutierrez said he will be making presentations within the next couple of weeks to other taxing entities within the county to let them know about the change in how property tax foreclosure sales, how the new system will work and any impact it may have on collections. He said he had spoken to area school superintendents, who seemed to be on board with the change.

Chief Appraiser Stan Hemphill, District Clerk Casie Walker and Sheriff Calvin Boyd all praised the new system, stating it will make it easier to conduct foreclosure auctions for their departments.

“This will certainly help out my civil deputies,” said Boyd, who is responsible for overseeing the sale as the sheriff. “It should also make it easier on folks to bid. I assume this is the future for how we will be doing business.”

County Attorney Eddie Arredondo did warn Gutierrez and commissioners, however, they should make sure buyers know they will be responsible for paying off any liability or lien which has been placed on a property they purchase.

Now that commissioners have approved the change, by law, the county must publish the new rules in the designated record of the county and then wait 90 days before they are able to hold their first online auction, so the new auction platform will likely not go into effect until July or August, Gutierrez said. The county also will continue to publish foreclosure sales in the Burnet Bulletin and its sister newspaper, The Highlander, as the newspapers of record for Burnet County.