FEMA presents flood maps Tuesday night

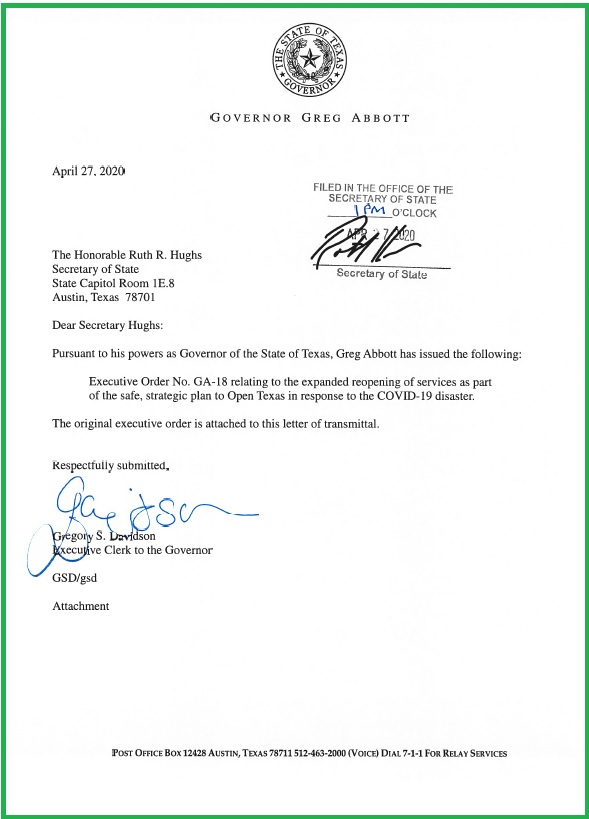

Glynis Crawford Smith/The Highlander

To learn more about proposed changes in local Flood Insurance Rate Maps (FIRMs), Steve Reitz president of the Marble Falls Economic Development Corporation Board of Directors, left, joins, Mike Ingalsbe, building official/floodplain administrator for the City of Marble Falls, and Mercedes McCloughan All State Insurance, right, for one of three workshops in city council chambers Thursday. Another free event Tuesday, April 24, will be open to everyone in the Burnet-Williamson County area.

By Glynis Crawford Smith

The Highlander

The Federal Emergency Management Agency (FEMA) is updating Flood Insurance Rate Maps (FIRMs) for this area and that can mean a lot to to bottom line of your insurance bill.

To help residents better understand where the changes are occurring on the new flood maps and their impact, Burnet County and the City of Marble Falls have partnered with FEMA to hold an Insurance Workshop from 2-7 p.m. Tuesday, April 24, at Marble Falls Lakeside Pavilion, 307 Buena Vista Drive. It will focus on Region 6 (Burnet and Williamson counties).

Homeowners, renters and business owners in Burnet County cities and unincorporated areas are encouraged to attend to obtain more information about the proposed changes and risk information.

“As we work together with our state and local partners to bring this critical information to these counties, we ask that everyone review the maps to understand what flood risks are involved,” said FEMA R6 Administrator Tony Robinson. “The role of the community as an active partner in the flood mapping process is very important.”

Three introductory meetings were held Thursday, March 22, in Marble Falls because the window for appeals is closes May 14 and some people's property may have changed flood zone designation.

“We wanted to give people the opportunity to see the map for their area and to understand what changes can mean,” said Mike Ingalsbe, building official/floodplain administrator for the city. “Flood risks change over time, based on new building and development, weather pattern changes, and other factors. We are about to see changes in our maps for Region 6 (Burnet and Williamson counties).”

“The proposed maps for this area came out in mid-February but now comments or appeals are due May 14,” said Ingalsbe. “Each of our early workshops had about a dozen citizens but there may be more questions out there.”

The FEMA Risk Mapping, Assessment and Planning (Risk MAP) program is designed to help communities nationwide to assess flood risks, and encourage mitigation planning for future disasters.

But people know their own property. They may want to contest a zone change or at least plan for the insurance hit coming if they are required to have flood insurance.

Ingalsbe invited local insurance agents Shane Stewart or State Farm Insurance and Mercedes McCloughan of All State Insurance to help him and Chelsea Seiter-Weatherford, city GIS coordinator answer questions at his early workshops.

One question there concerned the 2012 success of Horseshoe Bay in having areas removed from Zone A designations.

“The property owners and the city banded together,” said McCloughan. “It is the best chance for a successful appeal.”

Short of that, property owners can take another action to help with their insurance rates.

“If you are not presently in a flood zone—a Zone X, and you put a “preferred policy” in place ahead of the maps that place you in Zone A, that will lock in rates for a couple of years.”

The April 24 workshop in Marble Falls will help people understand where changes are occurring on the new flood maps and their impact. It will include discussions about:

There is no charge for this workshop and more information is available by calling Ingalsbe's staff at 830-798-7095. A proposed Marble Falls FIRM and a variety of information can be found at wwwmarblefallstx.gov/584/FIRM-Update-Risk-MAP.

For more information about flood insurance, visit www.fema.gov/national-flood-insurance-program.