MFISD lowers tax rate by penny

Lew K. Cohn/The Highlander

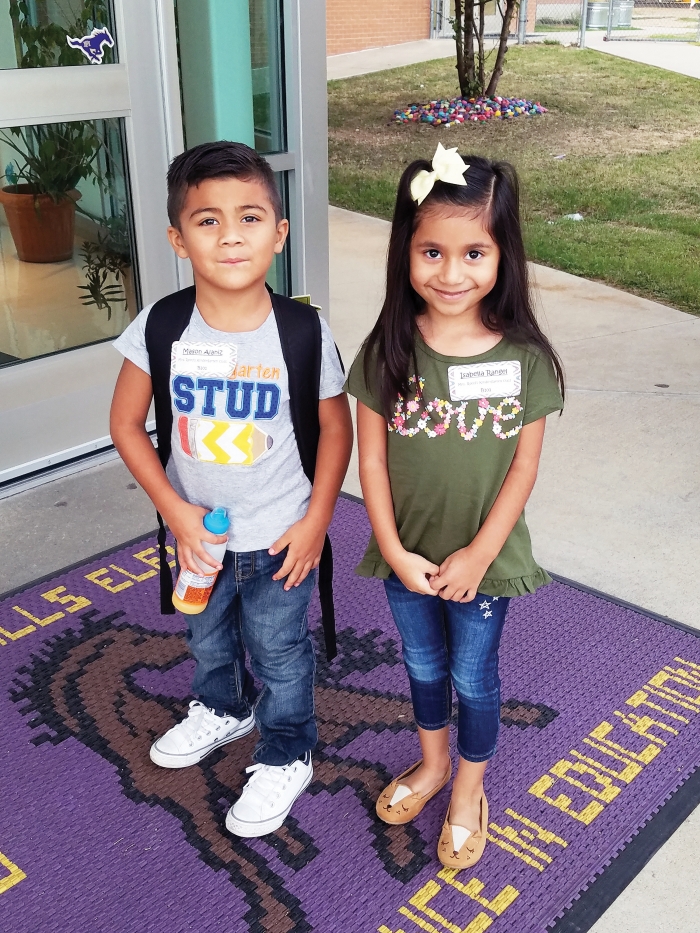

Kindergarten students Mason Alaniz, left, and Isabella Rangel are ready to start the first day of school at Marble Falls Elementary on Wednesday, Aug. 22. Both students are in Mrs. Reed's class.

By Lew K. Cohn

Managing Editor

The Highlander

Marble Falls Independent School District trustees lowered their tax rate by a penny per $100 valuation Monday night and also adopted a nearly $48.17 million balanced general fund budget for fiscal year 2018-19.

Trustees adopted a new maintenance and operations, or M&O, rate of $1.0533 per $100 valuation, which is the same as the current fiscal year. However, they adopted an interest and sinking, or I&S, rate of 21.53 cents, which is one cent lower than the current I&S rate of 22.53 cents. The new total tax rate for MFISD will be $1.2686 per $100 valuation.

Due to an increase in property valuations by the Burnet Central Appraisal District and new construction within the district, MFISD is projected to take in about $6.17 million more in local taxes than it collected in fiscal year 2018 with the new tax rate.

Previously, MFISD had proposed a $46.7 million general fund budget which called for a $416,410 deficit, to be made up through use of available district fund balance. However, district director of finance Melissa Lafferty said the district's certified taxable value increased by nearly twice as much as budgeted, allowing the district to add back some previously cut positions and removing the need to use fund balance.

“We had projected an increase of about six percent in our certified values, and instead, they came back at an 11.869 percent increase, so we were able to propose a balanced budget,” Lafferty said. Total certified value for Marble Falls ISD is $3.34 billion.

The adopted general fund budget projects local revenues will be at just under $42 million with state revenue at $5.56 million and federal revenue at $620,000. The largest expense for MFISD is payroll at nearly $33.46 million, followed by contractual services at $11.2 million.

This latter expense includes a projected $7.86 million recapture payment to Texas Education Agency. As a property-wealthy school under Chapter 41 of the Texas Education Code, commonly referred to as “Robin Hood,” Marble Falls ISD is required to send money to the state for redistribution to poorer school districts.

TEA is charged with “recapturing” funds from the property wealthy districts to redistribute to the property poor districts, based upon a formula involving weighted average daily attendance and property tax revenue.

By comparison, in fiscal year 2018, Marble Falls ISD sent nearly $4.63 million to the state, making this year's payment an increase of more than $3.23 million, or a 70 percent increase from last year. Since 2005, the district has been forced to send more than $48.67 million back to the state for recapture, an average of more than $3.48 million per year.

The district is expected to collect nearly $8.53 million in local revenue from debt service and spend about $7.08 million for a budget surplus of $1.55 million.

Lafferty presented three options to trustees to consider for the debt service rate — keeping the rate the same as in 2018 at 22.53 cents; lowering it by a penny to 21.53 cents; or dropping it by 1.5 cents to 21.03 cents.

She was asked why administrative staff supported a one-cent decrease instead of a 1.5-cent decrease and it was indicated the district would have more flexibility to pay off debt early in the future if it approved the smaller decrease of one penny.

Lafferty said MFISD has paid off approximately $50 million in bonded interest at a faster rate than expected by refunding debt since 2009, which has resulted in interest savings of approximately $15 million for the district.